Indicators on Custom Private Equity Asset Managers You Need To Know

(PE): investing in companies that are not publicly traded. About $11 (https://cpequityamtx.wordpress.com/). There may be a few things you do not comprehend about the sector.

Personal equity companies have a range of financial investment choices.

Because the best gravitate toward the bigger bargains, the middle market is a dramatically underserved market. There are more sellers than there are extremely experienced and well-positioned financing professionals with considerable buyer networks and sources to handle a deal. The returns of private equity are usually seen after a couple of years.

What Does Custom Private Equity Asset Managers Mean?

Flying listed below the radar of huge international corporations, a number of these small business commonly give higher-quality customer care and/or particular niche services and products that are not being used by the big conglomerates (https://cpequityamtx.wordpress.com/). Such benefits draw in the interest of exclusive equity firms, as they possess the insights and savvy to manipulate such opportunities and take the firm to the following degree

A lot of managers at portfolio companies are given equity and incentive payment frameworks that award them for striking their financial targets. Personal equity possibilities are often out of reach for people that can't invest millions of dollars, however they should not be.

There are guidelines, such as limits on the accumulation amount of money and on the number of non-accredited investors. The exclusive equity company attracts a few of the most effective and brightest in business America, including top entertainers from Lot of money 500 companies and elite management consulting firms. Law office can also be hiring premises for website link private equity works with, as audit and legal abilities are essential to complete bargains, and deals are extremely looked for after. https://cpequityamtx.carrd.co/.

Not known Factual Statements About Custom Private Equity Asset Managers

One more drawback is the lack of liquidity; when in a private equity deal, it is hard to get out of or offer. There is an absence of adaptability. Personal equity additionally comes with high charges. With funds under management already in the trillions, private equity companies have actually ended up being appealing financial investment automobiles for well-off people and organizations.

For decades, the qualities of private equity have made the possession class an attractive suggestion for those that can get involved. Currently that accessibility to private equity is opening approximately more private investors, the untapped possibility is becoming a reality. The inquiry to think about is: why should you invest? We'll start with the main disagreements for buying private equity: Exactly how and why exclusive equity returns have actually historically been greater than other possessions on a variety of levels, Exactly how including private equity in a profile impacts the risk-return profile, by helping to expand against market and intermittent risk, Then, we will certainly outline some vital factors to consider and dangers for private equity financiers.

When it involves presenting a brand-new possession into a profile, the a lot of standard factor to consider is the risk-return account of that asset. Historically, private equity has shown returns similar to that of Arising Market Equities and greater than all other standard possession courses. Its reasonably reduced volatility paired with its high returns makes for a compelling risk-return account.

Custom Private Equity Asset Managers Can Be Fun For Everyone

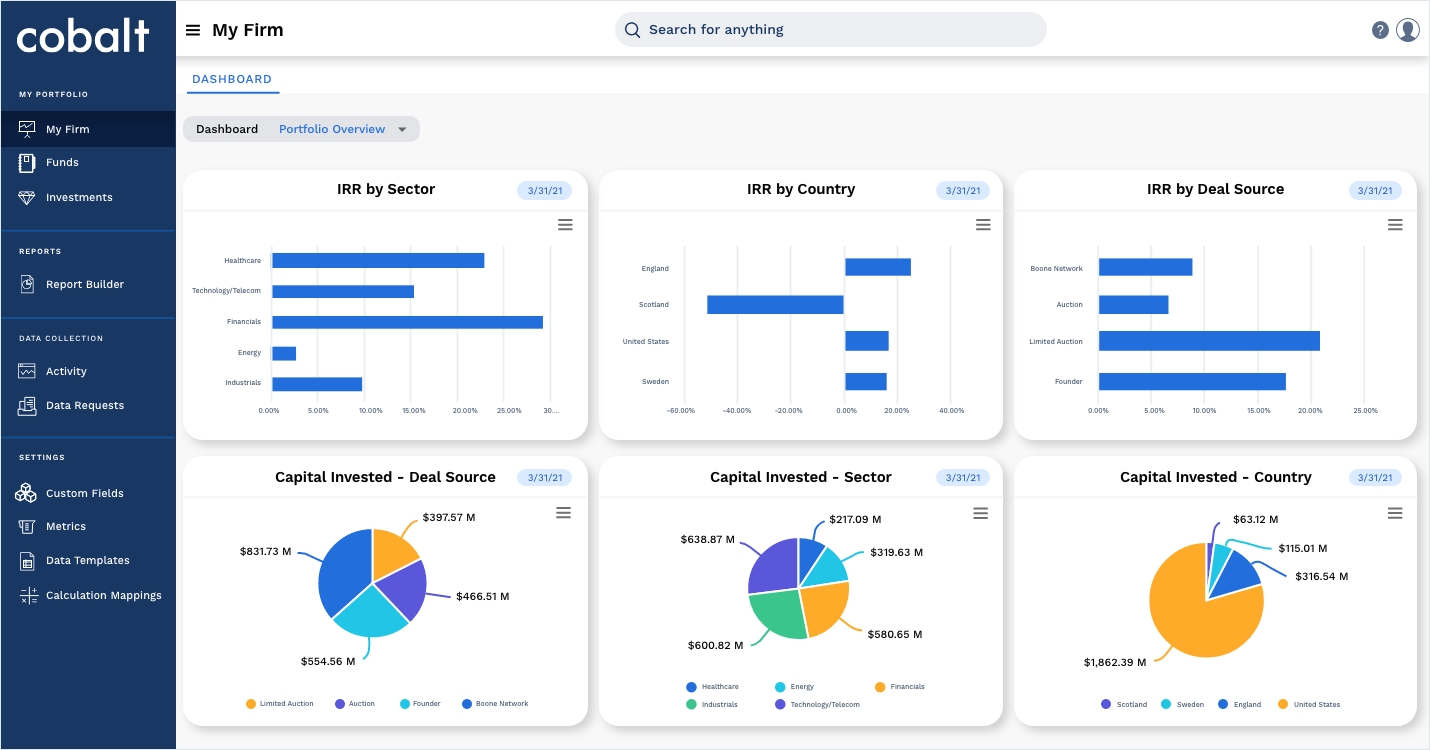

Actually, exclusive equity fund quartiles have the largest variety of returns throughout all different possession classes - as you can see listed below. Technique: Interior rate of return (IRR) spreads out computed for funds within classic years individually and then balanced out. Mean IRR was computed bytaking the standard of the median IRR for funds within each vintage year.

The result of adding private equity right into a profile is - as constantly - dependent on the portfolio itself. A Pantheon research from 2015 suggested that including personal equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the most effective personal equity firms have accessibility to an also larger pool of unidentified chances that do not deal with the very same analysis, as well as the sources to execute due persistance on them and determine which deserve investing in (Syndicated Private Equity Opportunities). Investing at the first stage indicates greater risk, but also for the companies that do prosper, the fund take advantage of greater returns

The Best Strategy To Use For Custom Private Equity Asset Managers

Both public and personal equity fund managers dedicate to investing a percentage of the fund however there remains a well-trodden problem with straightening rate of interests for public equity fund monitoring: the 'principal-agent trouble'. When an investor (the 'primary') employs a public fund supervisor to take control of their capital (as an 'agent') they hand over control to the manager while keeping possession of the possessions.

In the instance of personal equity, the General Companion does not simply gain an administration cost. Exclusive equity funds also reduce another form of principal-agent problem.

A public equity financier eventually wants something - for the monitoring to boost the supply cost and/or pay dividends. The capitalist has little to no control over the choice. We showed above the number of exclusive equity strategies - specifically bulk buyouts - take control of the operating of the business, guaranteeing that the long-lasting value of the business precedes, rising the roi over the life of the fund.